tulsa oklahoma auto sales tax

As of July 1 2017 Oklahoma. See reviews photos directions phone numbers and more for the best Taxes-Consultants Representatives in Tulsa OK.

Tiger Gooseneck Dump Trailer 77x14 Tandem 6k Axles With Brakes 2 Ft Sides 10 Guage Double Rear Doors Utility Trailer Trailers For Sale Enclosed Cargo Trailers

Whether you live in Tulsa Broken Bow or Oklahoma City residents are required to pay Oklahoma car tax when purchasing a vehicle.

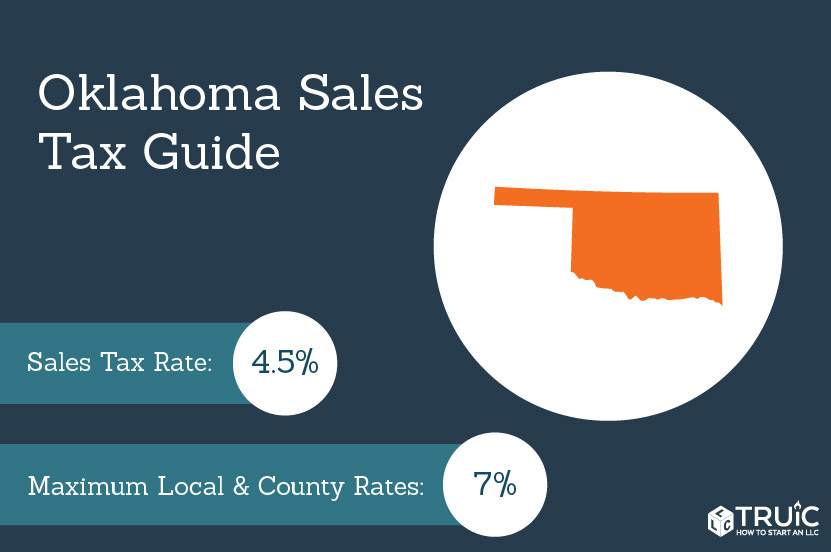

. Above 100 means more expensive. This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax. The sales tax rate for the Sooner City is 45 however for most road vehicles there is a Motor Vehicles Excise Tax assessed at the time of sale or when the new Oklahoma car title is issued in the new owners name.

Select the Oklahoma city from the list of popular cities below to see its current sales tax rate. Forums Oklahoma Tulsa. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

Taxes in Brownsville Texas are 162 cheaper than Tulsa Oklahoma. The annual registration fee for non-commercial vehicles ranges from 15 to 85 depending on the age of the vehicle. No credit card required.

The value of a vehicle is its actual sales price. Returns for small business Free automated sales tax filing for small businesses for up to 60 days. Also the excise tax is based on a percentage of the purchase price of the vehicle as long as the purchase price is within 20 of the average retail value for that specific model vehicle.

The excise tax IS 325 and cars are not assessed sales tax at least on the line item. Auto registrationsales tax User Name. Together these two motor vehicle taxes produced 728 million in 2016 5 percent of all tax revenue in the state.

Oklahoma has recent rate changes Thu Jul 01 2021. This is the total of state county and city sales tax rates. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

If the purchased price falls within 20 of the. 2000 on the 1st 150000 of value 325 of the remainder. 325 of taxable value which decreases by 35 annually.

In Oklahoma this will always be 325. With local taxes the total sales tax rate is between 4500 and 11500. For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter.

Your exact excise tax can only be calculated at a Tag Office. This method is only as exact as the purchase price of the vehicle. The excise tax is 3 ¼ percent of the value of a new vehicle.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. 4 rows Tulsa OK Sales Tax Rate. The Oklahoma sales tax rate is currently.

The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. The actual excise tax value is based on the Blue Book value as established by the Vehicle Identification Number VIN. The current total local sales tax rate in Tulsa OK is 8517.

New and used all-terrain vehicles utility vehicles and off road motorcycles. The state sales tax rate in Oklahoma is 4500. OKLAHOMA CITY The Oklahoma Supreme Court on Thursday ruled that a 125 percent sales tax on vehicles was not a tax increase because it only removed an exemption.

Sales tax at 365 2 to general fund. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4242 on top of the state tax. Below 100 means cheaper than the US average.

The measure removes the sales-tax exemption on vehicles thus imposing a 125 percent tax on top of the existing 325 percent excise tax. So dont expect to pay 8 sales tax. 325 of ½ the actual purchase pricecurrent value.

State of Oklahoma - 45. Mayor Dewey Bartlett said today that the City of Tulsas January sales tax revenue for mid-November to mid-December as reported by the Oklahoma Tax. Lawmakers passed House Bill 2433.

100 US Average. This is only an estimate. The County sales tax rate is.

Tulsa County - 0367. 325 of 65 of ½ the actual purchase pricecurrent value. Take Your Drive to the Next Level.

325 of the purchase price or taxable value if different Used Vehicle. Multiply the vehicle price after trade-ins and incentives by the sales tax fee. About our Cost of.

Oklahoma does not charge a sales tax on cars. And I dont believe they are assessed it anyway. Excise tax on boats and outboard motors is based on the manufacturers original retail selling price of the unit.

The City has five major tax categories and collectively they provide 52 of the projected revenue. This is the largest of Oklahomas selective sales taxes in terms of revenue generated. For example imagine you are purchasing a vehicle for 50000 with the state sales tax of 325.

The Tulsa sales tax rate is. 11-08-2008 0934 AM. Sales Tax in Tulsa.

For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter. Motor vehicle taxes in Oklahoma are both selective sales taxes on the purchase of vehicles and ongoing taxes on wealth the value of the vehicles. Just the 325 excise tax.

City-Data Forum US. Standard vehicle excise tax is assessed as follows.

38 Sundowner 1786gm Toy Hauler Gooseneck Race Trailer Camping All Aluminum Enclosed Trailer Hitch It Trailer Sales Trailer Parts Service Truck Acces รถยนต

Hitch It Tulsa Ok Trailers For Sale Enclosed Cargo Trailers Towing Vehicle

Race Trailer Oklahoma Tulsa Haulmark Edge Pro Race Trailer Racing Race Car Driver Car Hauler Transporter Sprint Trailers For Sale Truck Accessories Sprint Cars

Race Trailers Oklahoma Tulsa Haulmark Edge Pro Race Trailer Racing Race Car Driver Car Hauler Transporter Sprint C Trailers For Sale Sprint Cars Car And Driver

Car Donations Mn Deduction Car Donate

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Trailers For Sale Aqua Lily Pad Lake Time

Tulsa Trailer Parts Shop Tulsa Trailer Sales Hitch It Trailer Sales Trailer Parts Service Tru Trailers For Sale Landscape Trailers Enclosed Cargo Trailers

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Trailers For Sale Aqua Lily Pad Lake Time

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Trailers For Sale Truck Accessories Car Trailer

38 Sundowner 1786gm Toy Hauler Gooseneck Race Trailer Camping All Aluminum Enclosed Trailer Hitch Utility Trailer Aluminum Enclosed Trailer Trailers For Sale

1953 Mid West Chevrolet Dealership Tulsa Oklahoma Chevrolet Dealership Car Dealership Used Car Lots

Sundowner Motorsports Race Series Enclosed Car Hauler Race Trailer All Aluminum Hitch It Trailer Sales Enclosed Car Hauler Utility Trailer Trailers For Sale

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Trailers For Sale Truck Accessories Utility Trailer

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Trailers For Sale Utility Trailer Truck Accessories

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Trailers For Sale Truck Accessories Enclosed Trailers

Car Sales Tax In Oklahoma Getjerry Com

Sundowner Motorsports Race Series Enclosed Car Hauler Race Trailer All Aluminum Hitch It Trailer Sales Trailers For Sale Utility Trailer Enclosed Car Hauler

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Trailers For Sale Truck Accessories Sprint Cars